Ally Economic is just one of the prominent auto loan team throughout the United states

Refinancing your auto loan otherwise to order a leased vehicle is a wise financial choice, however, as long as you decide on the best financing terms. Look at this remark to greatly help decide if a good Clearlane car finance is really worth considering.

If you're not obsessed about Clearlane, here are a few the overview of the best auto loan company into the a. We contrast most useful businesses by the thinking about interest rates, lowest app criteria, financing terms and conditions, plus.

- Advanced buyers product reviews

- Lower rates for good credit consumers

- Good community profile

- Average monthly deals from $150

- Work at an unsecured loan concierge examine options

Every - delight check lover web site to have latest facts. Rate can vary considering credit rating, credit score and loan term.

Friend Clearlane Opinion: step 3.5 Superstars

Full, i rates Clearlane which have step 3.5 celebrities. A lot of people is also qualify, but Clearlane will not supply the reduced rates in the industry. However, Ally Clearlane automotive loans can be worth looking into due to the company's simple, risk-free software process.

Friend Clearlane Pros and cons

Refinancing to find a lowered payment is a beneficial tip, particularly if your credit rating has increased, when you yourself have went, or you have purchased a house. Clearlane's prequalification is easy and won't impression their borrowing. Several other sweet most important factor of the financial institution would be the fact it generates loans readily available for Gap insurance in addition to car service agreements, which will surely help keep the auto safe on the move.

The fresh cons to help you Clearlane is this may have stricter qualification requirements than many other businesses features apparently poor support service. Numerous people has actually reported throughout the complications with customer agents and exactly how enough time it requires having loan payments becoming placed on their profile.

Regarding Friend Clearlane

Clearlane was part of Ally Monetary, which is situated in Detroit, Michigan, possesses offered monetary attributes for over millennium (to begin with while the Standard Vehicles Allowed Company). The company brings automotive loans so you can consumers over the You.S., with the exception of Las vegas.

Ally Clearlane Car Home mortgage refinance loan Details

Friend Clearlane offers vehicles refinance financing and you may rent buyouts, and Pit insurance coverage and auto services contracts . (Ally Financial has the benefit of auto buy financing alone.) Auto loan info vary dependent on your credit rating and you will the car you should re-finance.

Ally Clearlane Car loan Software Techniques

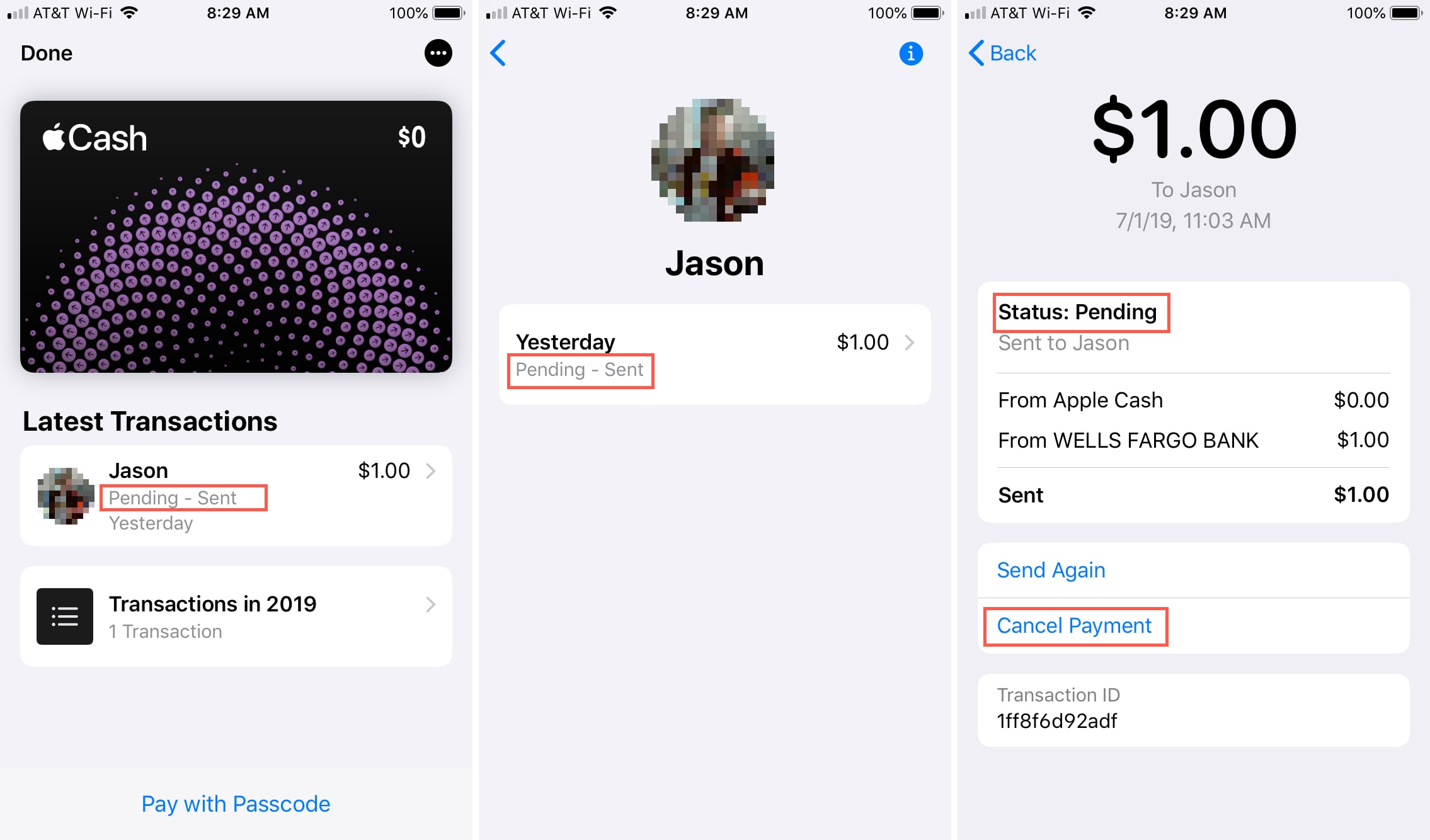

To try to get an excellent Clearlane car finance, potential borrowers need complete a good prequalification processes. The application does not require one get into your own public protection or credit card amount and won't cause a hard credit check. Thus your own credit will not be influenced.

You could potentially submit an application for a great Clearlane loan since just one or having a great co-candidate and additionally be motivated add next suggestions:

The program techniques is really small that can become value finishing just to see just what words youre offered. If you choose to undergo together with your financing provide, Clearlane should focus on a hard credit score assessment, which may affect your credit score.

Minimum Official certification

Not every person often click over here now qualify for a friend Clearlane car finance. Is acknowledged, candidates need to have the very least credit score out of 580 and you may an excellent minimum income off $dos,000 a month. Unless you satisfy such certification, you will need to see a great co-signer that have a much better credit score in order to secure a beneficial Clearlane financing.

Ally Clearlane Consumer Reviews And Character

Clearlane's mother team, Friend Financial, has a good D- rating throughout the Bbb (BBB). It's got a better business bureau consumer comment get of 1.1 of 5.0 celebrities and an effective Trustpilot remark rating of just one.step 3 off 5.0 a-listers.

When you're such ratings was reasonable, it is important to remember that he or she is predicated on a great relatively small number of recommendations and may not depict the majority regarding Clearlane consumers. Ally's Trustpilot get, instance, will be based upon under two hundred studies, which accounts for lower than 1 percent of its customers. Nonetheless, worst online customers ratings and you can a lack of positive reviews are bad cues towards the providers complete.

Confident Clearlane Product reviews

Regardless of if Ally's critiques are often bad, there are lots of vehicle operators which compliment Clearlane for the customer support. One driver produces:

Fantastic organization. Many of these negative ratings are from people who have guilt away from some kind. Read their agreements, some one... We have financed with Friend because the 2006. In advance of 2009, their term are GMAC. It will be the exact same amazing providers and constantly might be.

Negative Clearlane Product reviews

A familiar ailment facing Clearlane are sluggish deposit moments. Numerous writers along with explore unpleasant customer support and you can difficulty choosing loans.

Ally's customer service 's the bad We have actually knowledgeable. Ask to dicuss so you're able to a manager, [and] might possibly await times or be gone to live in an excellent survey requesting so you're able to rate the service.

I refinanced my car during the of Ally to my bank. It did not pertain that examine to my car finance up until and another sign in July, [but] it performed deposit one another inspections into their membership March a dozen. [This was] 1 week when i refinanced and two days before the conclusion time of your own rewards letter. Today they are advising me I are obligated to pay her or him financing costs.

Friend Clearlane Remark: Completion

I ranked Ally Clearlane that have 3.5 celebrities due to its risk-free prequalification techniques and you may car insurance products. Ally Clearlane will likely be a alternatives for refinancing, however, remember that of a lot customers analysis show that there is actually complications with the qualities. Before choosing any vehicle refinancing provider we recommend you look at different companies and you may examine prices to really make the best choice.