Ideas on how to change your financial qualifications?

750 900: You'll find high chances of a debtor are entitled to an excellent financing having score contained in this class. As well as, the mortgage acceptance processes is short and you americash loans Wauregan will problem-100 % free. Not only that, he/she will additionally be capable negotiate to your amount borrowed and you may rate of interest with many different lenders and get an educated available financing promote. With your scores, he is able to including discuss for increased loan amount and an excellent all the way down interest.

Eradicate playing with Credit cards with reasonable balances if you are paying them out-of immediately or move them to several other existing credit. This will help you prevent your CIBIL score from shedding.

Carry-forward of left balance to the next month tend to just focus a heavy interest, in addition to adversely connect with your own rating.

If you think you could potentially overlook the fresh commission out-of fees unwittingly, decide for an auto-debit. This may render your own bank the latest mandate to debit this new month-to-month financing from your account towards the a fixed day each month. Make sure to keep up with the called for harmony on the membership for the pre-determined day, so you aren't charged much notice considering the ineffective car-debit processes.

When you have an in-supposed mortgage, afford the fees really within this date every month to alter the score and set good credit score to have future loan providers.

Definitely look at the loan document thoroughly and you can clear their second thoughts before signing on dotted line, thus avoid your self out of getting caught clueless later on.

Remove economic actions you to means risks to help you a beneficial credit score, like providing payday loans on your Handmade cards. It notification lenders in regards to you up against economic worry.

Look at your credit file before applying for a loan to make certain there aren't any errors or omission regarding purchases. If you find discrepancies or frauds, have it rectified because of the increasing a great CIBIL conflict before applying to have a home loan.

Avoid being a loan guarantor. If the borrower defaults when you look at the using expenses promptly, it generally does not only connect with the info nevertheless may also have to pay the debt toward his/her account.

- Mortgage EMI CALCULATOR

- Home loan Eligibility CALCULATOR

- Financial Balance Import CALCULATOR

- STAMP Responsibility CALCULATOR

- Tax CALCULATOR

- Mortgage Getting Doctors

- Mortgage To possess California s

- What exactly is CIBIL Score?

- Just how to View CIBIL Score

Spend their month-to-month fees on your Mastercard in the specified deadline per month and maintain of purchasing just the minimal matter due

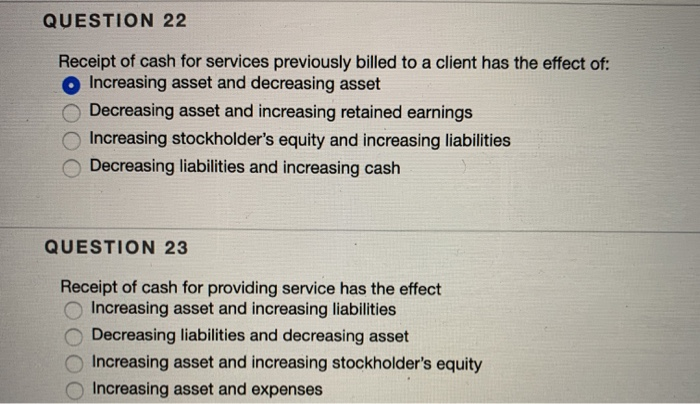

The new CIBIL rating is one of the very first things one financial checks after they discovered home financing application, because it's an accurate understanding of a person's borrowing and you may fees record and you can highlights the creditworthiness.

Should you decide to try to get a mortgage, here is what you should do to alter the qualification to have securing it:

Logically, the better your CIBIL Score are, the greater try your odds of being qualified getting a sizeable loan amount that have less Mortgage interest rate. Brand new CIBIL get was authorised by Borrowing Suggestions Agency (India) Restricted, a body licensed of the Put aside Financial regarding India.

If you are planning to try to get home financing, it is recommended that your check your CIBIL Rating and employ the newest means to enhance they, if it is underneath the lender's qualification requirements. This may imply clearing away from current debts and you will making sure the information about this new CIBIL webpages was current. It just enhances the top-notch your application plus minimises the probability of the application getting rejected.