Just what Credit rating Is required having a home Update Loan?

Individuals develop, and thus is all of our property. People that place effort for the creating the dream property dont want to relax towards the 1st construction of the quarters and maintain renovating their homes to own a far greater lifetime.

Financial institutions enjoys certain choices for do-it-yourself loans. This particular article targets home improvement loans, their qualifications, and you can who'll safer them.

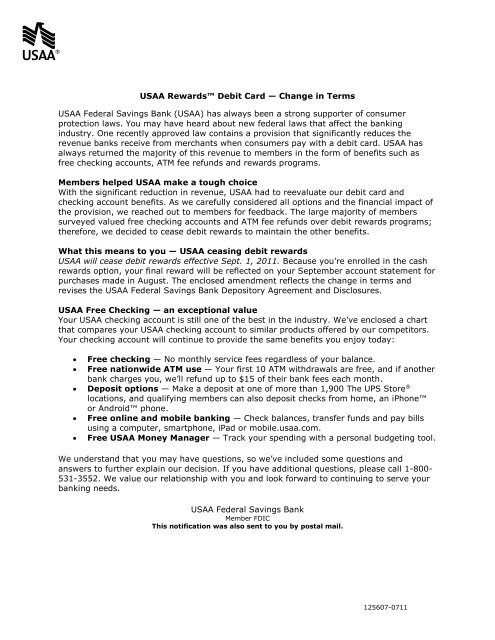

Unsecured loans take the credit score of one's customers under consideration. Banking companies manage a credit history per loan borrower. The credit Guidance Agency Minimal (CIBIL) functions credit rating calculations with many different products such as for example payment record, borrowing visibility, and you will borrowing from the bank type.

Early in the day Fee Background That it basis secures a top weightage regarding 30% certainly one of most of the that will be computed in accordance with the normal and you may self-disciplined fees of earlier in the day money.

Borrowing from the bank Publicity -. It foundation 's the proportion of your credit worth employed by the client on overall borrowing worth readily available.

Borrowing from the bank Use Proportion Quantity of borrowing utilized/ Available credit limit. The low the financing utilization proportion is the probability of protecting financing raise.

Borrowing from the bank Kind of Offered lifetime of credit score and you may proper balance between your protected and you may personal loans will teach the feel of the latest applicants whenever balancing its credit score.

The brand new CIBIL score range of three hundred in order to 900. The fresh new people with high rating will easily safer home improvement funds. It is important to keep a get greater than 400 to take advantage of property improvement mortgage however, score a lot more than 600 try most useful as they let you know brand new large creditworthiness of your own customer. (Bring a source for it advice).

Do you know the Pros and cons off Do-it-yourself Fund?

Loans to possess improving all of our homes feature benefits and drawbacks. It's always best to learn the choices for do it yourself finance and pick the best one among the numerous loan applications one to will benefit your position.

Pros

- Somebody can also be safe an excellent amount of money within reasonable costs. This helps the newest candidate give quality value to their home having realistic interests and you can low rate fund give quality value so you can your house why not look here.

- To make use of the new broadening interest in home improvement arrangements, of several financial institutions give fund with the various criteria hence will bring their customers which have an array of solutions and you will selection.

- Those with down fico scores may safe do it yourself financing and you will financial institutions give loans lower than zero credit assessment do-it-yourself loans.

Drawbacks

- In the event the lenders realize that this new reount, they could possibly get devalue the house or property otherwise charge its individuals consequently.

- Just like the do-it-yourself financing can also be found given that no credit score assessment home improvement money, they won't are experts in protection or credit ratings. This might bring about a loss to your home loan organization.

- Certain financial institutions can increase the interest pricing to suit the loss it face in some cases.

Should i Rating a home Improve Mortgage With Less than perfect credit?

- Individuals which have all the way down fico scores may also make an application for mortgage brokers. There aren't any credit assessment do-it-yourself money in which the banking companies provide funds with high interest to possess poor credit ratings.

- Reduced scorers could possibly get use fund with the help of most other individuals which care for good credit. The individuals with a good score can also be co-sign this new data and you can act as co-consumers to make use of the loans.

- Another way will be to improve credit rating, however, that is a slower process. The consumer need certainly to get to know their ability and you may borrow money lower than limitations. Proper loan money over a specific months is also profitably improve get of your own applicant which will surely help him or her later on.