FHA Financing What exactly are They and just how create it works?

FHA loans versus Va finance usually are by far the most contended loan apps getting qualified borrowers. One another financing is actually authorities-supported and also have supporting issues, but per system has its advantages and disadvantages.

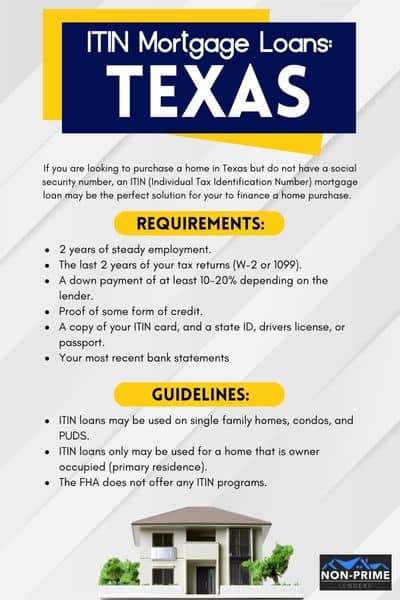

FHA funds try having individuals having bad credit, low income, or any other unique affairs. Because FHA promises this type of fund, lenders have a great deal more flexible guidelines.

This new Government Property Administration try an authorities agencies one backs FHA-recognized loan providers. It indicates they claim loan providers they pay them straight back a share of your own fund it shed if an FHA debtor non-payments toward the mortgage.

The FHA doesn't underwrite otherwise financing the fresh new financing merely FHA-recognized loan providers manage you to definitely part. The new FHA retains brand new be certain that having loan providers even in the event, to enable them to write finance to own riskier' borrowers.

You don't have to end up in a certain category otherwise enjoys a particular business to help you secure an FHA financing. It's the typical program to possess borrowers which do not be eligible for antique investment.

Va Finance Exactly what are They and how carry out they work?

Virtual assistant fund are getting pros of one's military or energetic people whom supported at the very least 3 months. Oftentimes, enduring partners out-of experts whom shed its existence during the or owed to their services tends to be qualified too.

Once you check FHA money vs Virtual assistant funds, possible notice a giant resemblance the newest Virtual assistant claims Virtual assistant funds including the FHA pledges FHA funds. This is the way Va-approved loan providers can offer flexible guidance in the event you offered the nation.

Va funds possess some more desirable provides to own veterans. For example, they don't you desire a down-payment, there isn't an optimum financial obligation-to-money proportion they need to see, so there isn't really home loan insurance rates.

However, Virtual assistant funds enjoys financial support fees for each and every mortgage your borrow. The fresh new money fee happens to the brand new Department regarding Experts Facts that will be how they always make sure loans for pros. You could potentially loans the purchase price on the financing, spending they along the 15 so you can 29-season name if you're unable to pay for they initial.

Property Sort of FHA Finance versus Va Finance

FHA financing and Virtual assistant finance is similar within property conditions. In the two cases, the home have to be the majority of your quarters. It means you'll live around 12 months-bullet. It's possible to have one minute household (vacation house), however you need to reside in which property all of the season therefore can not lease it out.

The most suitable choice to have consumers thinking of buying an investment home so you're able to either boost and you can flip or buy and rent is a traditional financing. If this interests you, call us and we'll make it easier to discover more.

Each other FHA fund and Virtual assistant financing need to have the home to getting for the safer, sound, and you can sanitary standing. For each mortgage system has certain Minimal Appraisal Requirements as well. They aren't some thing as well tough to meet and are usually on the best interests to ensure the residence is a good investment.

Down Costs FHA Money compared to Va Money

FHA finance want a 3.5% down-payment. You may be eligible to receive the financing due to the fact a gift for people who track all of them safely and stick to the financial guidelines, in general, you might simply acquire to 97.5% of property's value.

Virtual assistant finance do not require a downpayment. You could potentially acquire 100% of one's property's really worth, but it indicates you start homeownership and no security. Pros are able to lay money down on the home also though it is far from expected.

Financing Constraints FHA Loans compared to Virtual assistant Funds

Most loan software enjoys that loan maximum or an optimum matter you could use, however, Virtual assistant finance was an exception to this rule.

FHA money keeps mortgage restrictions which can be predicated on in which you alive. The fresh new restrict varies from $330,000 so you're able to $750,000 that will be according to the average price of home inside the the bedroom. If you reside inside the a premier-prices urban area, instance, you have much higher loan limits, but if you inhabit a decreased-cost city, the restrictions would-be much lower. There are no exceptions on FHA loan restrictions, so if you go beyond those limits and are also a seasoned, you'll be able to glance at the Virtual assistant loan.

Such i said above, Va financing don't have financing restrictions the statutes changed during the 2020, enabling pros to use up to it prove capable manage. There clearly was an exemption, no matter if. For those who utilized the experts ahead of and you will defaulted, you'll be able to lose one part of the qualifications, which means you is acquire less money, or if you obtain the same count, you should make up the difference having a down payment.

Debt-to-Income Percentages FHA Loans against Virtual assistant Financing

FHA financing features an optimum financial obligation-to-income proportion of about fifty%. Yet not, when you have compensating circumstances, such as for example a leading credit rating or great financing percentage history, lenders are prepared to undertake a somewhat highest DTI.

Virtual assistant money do not have a max obligations-to-earnings ratio. But not, when you yourself have a debt-to-money proportion higher than 41% you are susceptible to a closer article on your finances.

Your debt-to-income ratio will be upwards getting remark it does not matter which financing you choose. Most probably and sincere along with your mortgage officer to help your/their unique discover your position and you will matches you on the ideal loan.

Credit scores FHA Fund vs Virtual assistant Fund

Your credit rating is just as scrutinized as your financial obligation-to-income ratio. Such as your DTI, you can find out your credit score and you will improve it before applying for that loan. for a financial loan.

FHA lenders require an excellent 580-credit rating or maybe more if you would like generate good 3.5% down-payment. For those who have a credit score anywhere between 500 579, even if, you may still qualify but with an excellent ten% down-payment.

Virtual assistant money don't have a minimum credit rating needs, but the majority loan providers require increased credit history of the 0% deposit the brand new Va demands. Really loan providers need at least a great 620-credit score, however, there could be conditions.

For those who have a lowered credit history, even though you is an experienced, new FHA mortgage can be a better selection if you don't possess to compensate for circumstances that enable a great Virtual assistant bank to help you accept your loan.

Home loan Interest levels FHA Money vs Virtual assistant Finance

Consumers always love the attention rates, however when evaluating FHA and you may Va financing, i don't have far research. They both render aggressive interest rates, even so they are very different predicated on your being qualified situations like your credit rating, debt-to-money ratio, place, and you may payment record.

For top interest rate, alter your credit rating and you may loans-to-money ratio whenever you can. It is in addition crucial paydayloancolorado.net/bow-mar to be sure you have enough possessions to pay for people needed downpayment or settlement costs and you've got steady a job.